SKLN – Trade idea can 2nd of November 2016

This is live example of our live trade we took of of Nov 2 scan idea. Not 100% perfect trade but still just abve 10% ROI (return on investment) . If you choose right plays, you can be far from perfect and still make decent bank on your buck. More at stocktradermentor.com

Stay safe & Good Luck!

MJNA – Trade from scan 3rd of November 20116

Very nice opportunity on MJNA today right out off yesterday’s scan Nov 3. It might look to you like a chase on the first entry but it really was “Just in case it goes red” entry. Point is to manage size so you can embrace any opportunity to size in according to your plan. Besides scaling into a position, ths trade shows also nice example of pushing some size when trade starts working in your favor. At the end of the day with scaling in and out this was 21.9% ROI trade. Average entry price being $0.242 and average exit price of $0.189.

Since it’s an OTC name, this trade was 95% timed and managed of tape (L2 and T&S).

You are always free to share, like or post a comment or question. More on who we are at stocktradermentor.com

Stay safe & Good Luck!

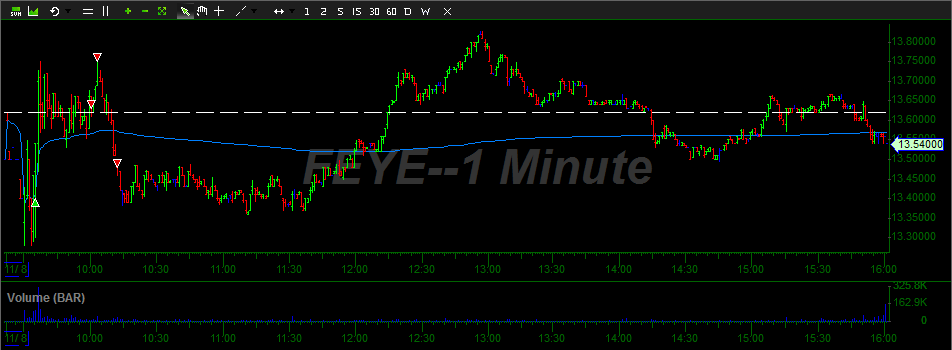

FEYE – Trade from scan 8th of November 2016

Today we had a good example of a trade you could be right or wrong on. Our intention is to emphasize the importance of having a PLAN, timing a trade and manage it right.

You need to come to the market prepared with a solid plan so you know what it is you’re waiting for. You need to have a solid plan and solid strategy in place you know you can rely on. Anything less than that will cause you to hesitate which later when you see your plan working will cause you to chase a trade.

Such action on trade like FEYE today would be difference between a win or loss. If you get your plan and you entry right it then comes down to trade management. What was your plan to begin with, is this a high conviction play, were you plan to let it play out with the bigger picture in mind or it is just a quick scalp trade to catch the predictable part of the move. You always need to have a plan! “Let’s see what it does” it’s not a plan!

I personally like to pay myself into a big moves and minimize headaches. I tend to let a piece ride ona real move but when wrong, I see no point in hoping for it to work.

If you find some value feel free to share, like or post a comment or question. More on who we are at stocktradermentor.com

Stay safe & Good Luck!

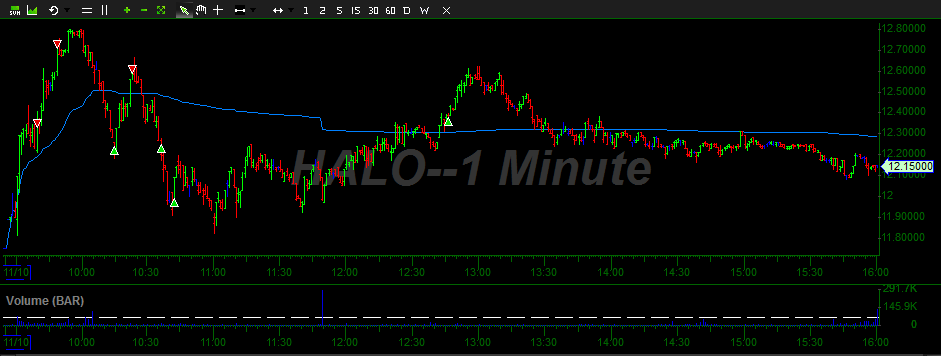

HALO – Trade from scan 10th of November 2016

Live trade example off 10th of November scan. If you missed the idea from the scan you can read it again HERE

I think this is a good example to show of how to size in and let bigger picture play out. Many times I have to listen to how I a let trade go against me and about my risk to reward being skewed against me. It is true that I aproach trading in more artistic way but my risk is always well managed. Let I 100 sahres position go against me 1 dollar or let I 1000 shares position go against me 10 cents, each time I lose 100 dollars it all comes down to what was my plan tobegin with. I always have my risk in mind when trading, so I may enter a trade early expecting it to go further against me, that’s when I start with partial position and add in once price is closer to my risk level bringing my average entry price up and shift risk to reward into my favor.

Many times trade starts working for me as soon as I start in, but that’s fine. If so, I may add to a winner bringing my risk closer to my entry point and trade smaller picture trade not swinging for the fances. On the other hand when trade goes agains me it’s an opportunity for me to size in and go for biger trade.

Managing size allows me to not get panicy on every single move what really boosts winn rate on my trades. Key in such way of trading is to not get stubborn. Even if you start small at some point you have to be wrong if trade dose not start behaving like you expacted it should you have to respect that, take it off and be wrong.

At this point I will thank you for giving me your time and offer you a hand in a friendly deal where I am prepared to give you my full attention for one month. If interested you are welcome to take a LOOK if not, feel free to use our Free Daily Scans or follow us on Twitter or StockTwits

Stay safe & Good Luck!

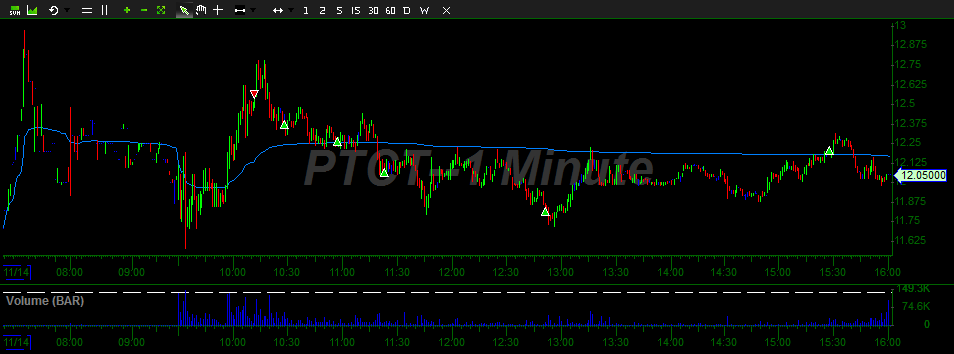

PTCT – Trade from scan 14th of November 2016

Live reactive trade example off 14th of November scan idea.

By reactive trade I mean trading without conviction and reacting to the price action. Usually I define risk levels and react on parabolic moves, volume and tape. You have to have clear risk and smart profit targets in mind. Not many times reactive trade tunns into an all day hold like my PTCT today. And by all day hold I’m not thinking about holding the entire position form entry to bell.

If you find some value feel free to share, like or post a comment or question. More on who we are at stocktradermentor.com

Stay safe & Good Luck!

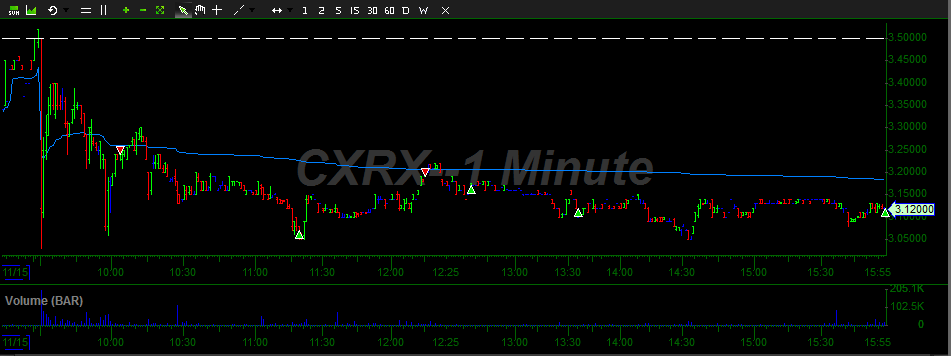

CXRX – Trade from scan 15th of November 2016

Live trade example off 15th of November scan idea.

Nice read on a dead cat bounce but I didn’t get the ideal trade as planned per can. I was having my eyes on shipping madness. Hard not to watch once in a year event! So I missed the first bounce on CXRX after it cracked green to red. The only other thing I could do better is locking in profits into wash into $3.05. I had an cover order sitting there on the bid but was unfortunately left behind. So overal OK trade but could have been much better.

If you find some value feel free to share, like or post a comment or question. More on who we are at stocktradermentor.com

Stay safe & Good Luck!